New Primerica Study Finds 86% of Middle-Income Households Have Been Financially Impacted by the Coronavirus Pandemic

Business Wire, July 2, 2020

Duluth – A new survey finds that 51% of the middle-income families who have been financially impacted by the economic fallout of the coronavirus pandemic are concerned about running out of money to pay for basic necessities by year-end. The national survey released today by Primerica, Inc. (NYSE:PRI), a leading provider of financial services to middle-income families in North America, gauges the financial outlook and preparedness of those with annual household incomes of $30,000-$100,000.

The study also reveals that 61% of middle-income Americans have had to cut spending in the wake of the pandemic, but fewer (53%) of those who had previously met with a financial professional have had to cut their overall spending.

“Primerica’s survey reaffirmed the importance of financial education and guidance in helping middle-income families safeguard their financial futures. These families are resilient, and we are encouraged that so many took steps to prepare for the unexpected,” said Glenn J. Williams, CEO of Primerica. “Primerica’s representatives are focused on helping middle-income families across North America during this difficult period.”

Key survey findings and data points about middle-income Americans and their financial situation during the pandemic include:

- Many are reexamining how they manage their money. Of the 86% of middle-income households that said they have been financially impacted by the pandemic in at least some way, a majority (54%) are reassessing how they approach managing their money. Younger respondents, and those who feel less secure in their jobs, are the most likely to say they are now thinking differently about their money management.

- A majority are concerned about having enough money for basic necessities by 2021. Respondents expressed deep concern about their ability to weather a medium or long-term economic downturn. Of those affected financially by the coronavirus pandemic, half (51%) do not expect to have enough money to meet their basic needs beyond December 31, 2020. Additionally, just 38% believe their personal finances will recover from the effects of the economic downturn in the next year.

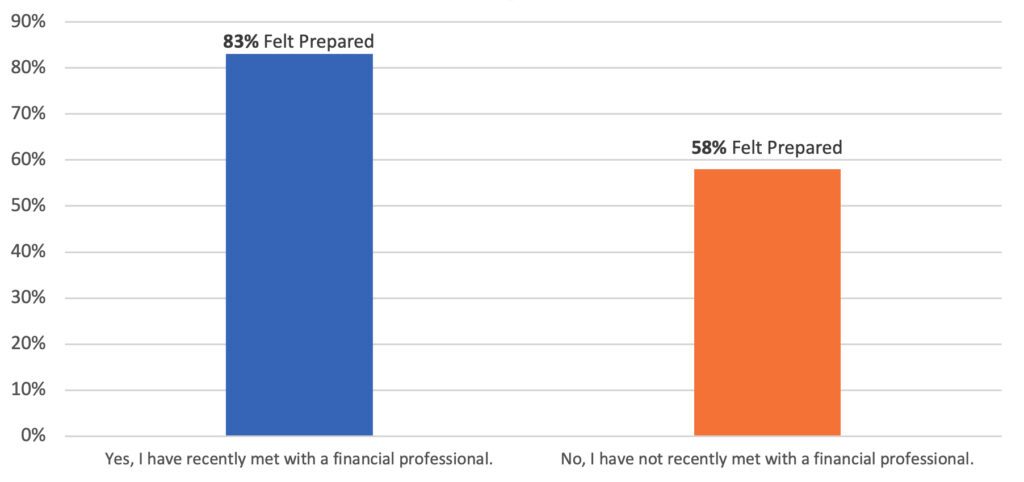

- Most of those who have recently met with a financial professional felt prepared for the financial impact caused by the coronavirus.

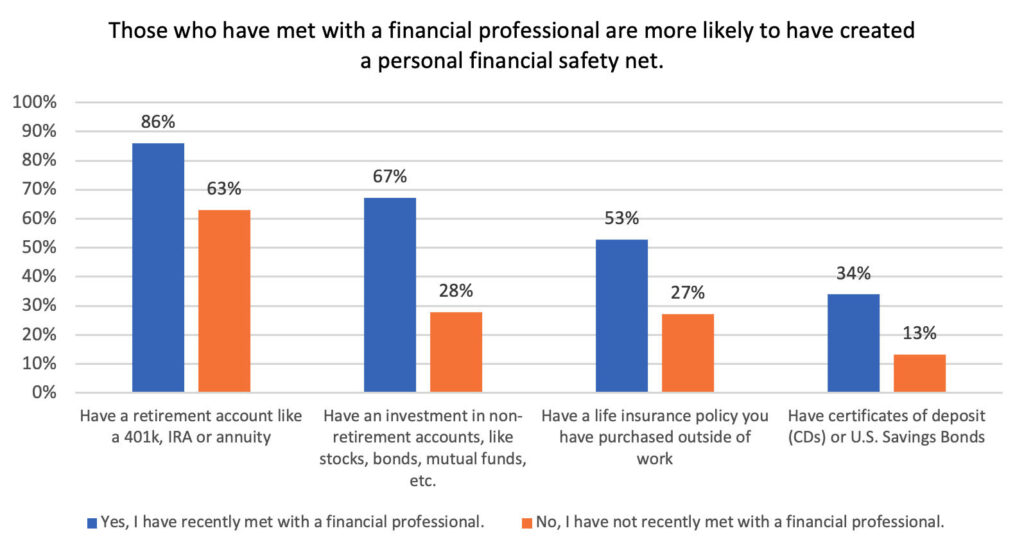

- Good financial habits may protect many middle-income families from greater financial impact.

Methodology

Polling was conducted online from May 15-17, 2020. Using Dynamic Online Sampling, Change Research polled 662 adults nationwide with incomes in 2019 between $30,000 and $100,000. Post-stratification weights were made on gender, age, race, education and Census region to reflect the population of these adults based on the five-year averages in the 2018 American Community Survey, published by the U.S. Census. The margin of error is 4.5%.

1238008

1 Comment

Comments are closed.

My intent is to bring financial education to my Facebook community and engage dialogue around topics on income protection, savings for retirement, debt elimination and earning additional income.